Chime To Cash App Limit

According to chime’s explanation, you can transfer from your external bank account to your chime spending account: No limit to the number of times per day up to $2,500.00 per day* the following are all subject to the $2,500 maximum amount that can be spent using the card per day :

Day 34 600 Day With Bitconnect! Software apps, Google

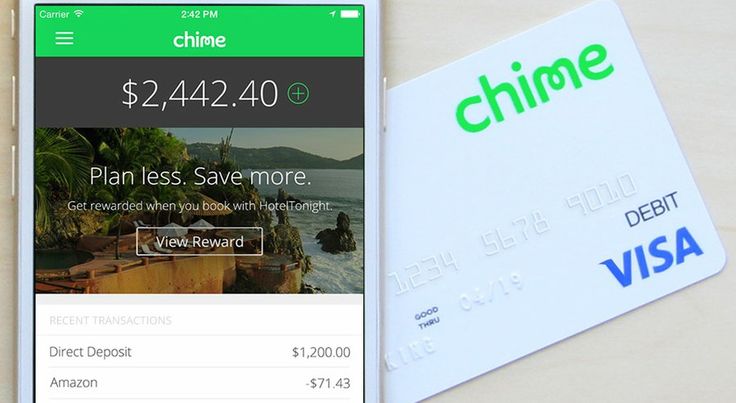

The chime visa ® debit card is issued by the bancorp bank or stride bank pursuant to a license from visa u.s.a.

Chime to cash app limit. Plus, there is no limit to the number of checks you can send each month. The chime atm withdrawal limit is $500 along with some conditions. Open your chime account using your smartphone or computer.

And may be used everywhere visa debit cards are accepted. Find chime and tap the icon. Reload your apple card and transfer to a different bank

Chime is the banking app that has your back. All qualifying members will be allowed to overdraw their account up to $20 on debit card purchases initially, but may be later eligible for a higher limit of up to $200 or more based on member's chime account history, direct deposit frequency and amount, spending activity. Chime money withdrawal limit via chime atm card:

Ask the cashier to make a deposit directly to your chime spending account. Next, you need to tap on your profile button and select the ‘add bank' option. But, like any other bank, chime too has an atm withdrawal limit.

You can't send large amounts of money with an unverified cash app account. Move to the transfer money option and enter the amount to transfer and hit the proceed button. You’ll be navigated to a page with the routing number and account number needed by your employer.

But there is no limit to how many times you withdraw money. Clicking “move money” in the mobile app. Your limit will be displayed to you within the chime mobile app.

Banking services provided by the bancorp bank or stride bank, n.a., members fdic. Chime can increase your spotme allowance up to $200 at its discretion based on your account history. You’re not limited to how many checks you can send per day, but the monthly limit is $10000.

You will receive notice of any changes to your limit. Chime provides atm withdrawal services with more than 38000+ branches all over the nation.`you can withdraw cash anytime with the help of the chime atm service. Open the chime app, tap move money at the bottom of your screen, then tap.

To join the credit builder waitlist, go to the chime app under settings and follow the instructions. You can add up to $1,000 every 24 hours for a maximum of $10,000 every month. You can check your spotme limit in the mobile app.

You can make up to 3 deposits every 24 hours. It is the most quirky feature of a mobile bank. Enter the cash app details such as name, phone number, and email address.

All qualifying members will be allowed to overdraw their account up to $20 on debit card purchases initially, but may be later eligible for a higher limit of up to $100 or more based on member's chime account history, direct deposit frequency and amount, spending activity. The app can be found on any mobile device or in your chime online account. You will need a chime spending account and payroll direct deposit of $200.

This option allows you to make up to three deposits each day, but the three deposits cannot be more than $1,000 in total. You need first to link your chime account to your cash app one. If you got apple pay.

Need to send a paper check? Here you'll be presented with a list of banks. For joint stimulus check make sure both of your signatures appear on the back of the check.

You have to be a chime member to join the waitlist and get early access to credit builder. Your limit will be displayed to you within the chime mobile app. Find retailers near you by logging into the chime app, clicking “move money,” “deposit cash” and then “see locations near me.”.

Chime does not accept any cash deposits at its atms, but there are multiple ways to add money to your account. You can start to withdraw even in. Chime has made setting up direct deposit easy.

Sign the back of your paper check, then write “ for deposit to chime only” under your signature. Chime allows you to withdraw $500 at one transaction. Or if you have another card like cash app or paypal you can link them to chime and send it to them paypal i think is withdraw limit of 2500cash app not sure about it or split it between them and use all at a sur charge free atm.

To do this, open up the cash app application on your phone. $200 in maximum per day $1,000 in maximum per month Click pay and the money will move to the cash app account.

A single day, but you’ll have to make the number of transactions up to $500 cash.

Varo vs. Chime Online Banks for Saving Money on a Tight

money get now aia file free download also admin aia file

Credit Card Churning 101 A Guide to Hacking Rewards

Chime Bank Helps You To Save... Automatically Smart

Chime is one of the fastestgrowing bank accounts in the U

How Do You Set the Limits on Financial Assistance? debt

Great information on borrowing and startup cost

CarbonNation Q&A 10/08/2019 Go fund me, Business pages

Chime App Promo Code How to get a 50 Cash Bonus Promo

Here's How to Limit Screen Time (and Tantrums) This Summer

Chime Spending Account Review Finance bank, Personal

Umi Ex Member Of CarbonNation Goes Live 1/12/2020 in

A mobile banking service designed with millennials in mind

Square Cash Get 5 For Installing Square Cash App

150 GT No Limit Texas Hold'em poker Tournament and

Chime Bank Customer Service Phone Number in 2020 Banking

Chime Bank Review How to Get 50 FREE with Direct

Post a Comment for "Chime To Cash App Limit"