Fee Free Atm For Cash App

Despite offering the service for free when it first started, cash app does charge a $2 fee per every atm withdrawal transaction. Cash app charges a 3% fee when paying by credit card and a 1.5% fee for instant transfers.

Square cash app card 10 OFF boost offers Cash card

8 simply use your porte debit card for $0 fee withdrawals.

Fee free atm for cash app. Unfortunately, there is no free mobile app option. Cash app charges a 3% fee if you send money from a credit card. Atm.com® is a free service with no monthly or annual fee for either our web services or mobile app, and helps you earn both active and passive income as dividends (as defined below, data dating dividends, reward dividends, and the colony data dividends are collectively referred to as “dividends”) in numerous ways, without atm.com selling your personal information (our limited rights to share your.

There is a maximum atm / cash back withdraw limit of $400 / day total from the branch card. Bank customer, you also have access to transact at moneypass network atms without a surcharge fee. Please refer to your card fee schedule.

The amount of money you can withdraw at an atm is also limited. Cash app instantly reimburses atm fees, including atm operator fees, for customers who get $300 (or more) in paychecks directly deposited into their cash app each month. You can never have too many options.

Standard transfers on the app to your bank account take two to three days and are free, while instant transfers include a 1.5% fee. However, there’s no fee to send money from your cash app balance or bank account, even if you send money to someone in the u.k. Other fees apply to the bank account.

Need the closest atm on your next trip? Visit business insider's homepage for more stories. As we mentioned above, you can send money across the pond with cash app, though it’s mainly a u.s.

Cash cards work at any atm, with just a $2 fee charged by cash app. Find it in your porte app. 2 it's easy to find moneypass atms in your area.

As a consumer, you gain access to the allpoint. Atm fees on cash card. Cash app fees can often be avoided by choosing the slower option and by never paying by credit card.

Bank atms or partner atms. Say no to ridiculous atm fees, and yes to free withdrawals. There are instances where cash app reimburses cash app users when they withdraw at atms using their cash card.

Once there, enter your location and select the atm checkbox filter for a list of nearby u.s. Cash app users who use their cash app cash card to withdraw at any given atm are charged a fee of $2. Cash app users who receive qualifying direct deposits that total up to $300 plus get reimbursed for every 3 atm withdrawals per 31 days or a full month.

Payment service, so it isn’t a solution if you’re trying to send money to friends and family across. Instapay send (bank to bank transfer) from banks where there is no fee 3. Please refer to your card fee schedule.

Green dot® network cash reload fees and limits apply. To find the nearest atm, visit the locations section of usbank.com or use the u.s. The simplest solution is to visit your bank or credit union when you need to withdraw cash, although that’s not always the most convenient option.

Cash app instantly reimburses atm fees, including atm operator fees, for customers who get $300 (or more) in paychecks directly deposited into their cash app each month. Neither green dot bank nor stash offers overdraft services. It’s your money and you’re going to have to fight to keep more of it in your wallet.

For overdraft, transaction is declined and no fee is charged. Ask a friend with a gcash account to help you out using send money: Your bank’s atm should be free for you to use, but customers from other banks most likely have to pay fees at the same machines.

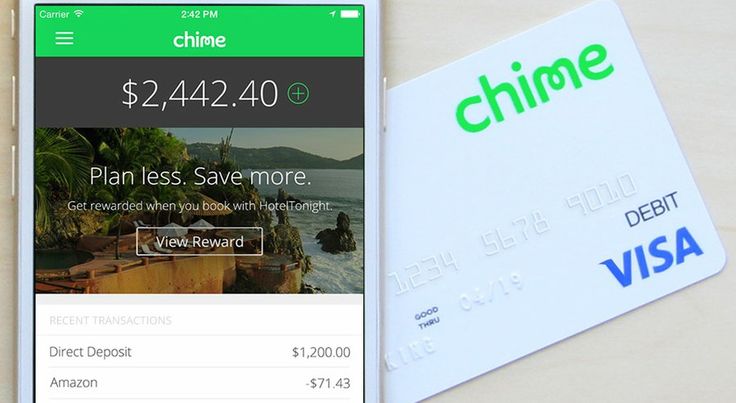

Some fees, like atm charges, will be reimbursed — up to 3 times per month and up to $7 per withdrawal — if you receive at least $300 in direct. Other online banks such as simple or chime have great options for atm usage. Once you have successfully activated free atm withdrawals, each qualifying deposit you receive after that will add an additional 31 days of atm fee reimbursements.

Viewing + changing your atm / cash back limit preferences. There is a maximum atm / cash back withdraw limit of $3,000.00 / month total from the branch card. With current, you can bank with no atm fees and instantly find a location near you on the atm locator map in our app.

Meglepetések és extra költségek helyett Transferwise

Derive Easy Support With No Fee Debit Card Loans

5 Times You Should Pay With a Credit Card, Instead of Cash

A mobile banking service designed with millennials in mind

No Fee Debit Card Loans Suitable Loan Deal for Solve

Current Student Account Bringing allowances into the

Free Money? 4 Apps to Make Earning Cash Back Simple Drop

These 5 Money Hacks Have Saved People A Fortune And Can

Apply Today Money Manual Chime Banking Budgeting

A Sneak Peek Into The Unreleased CASHCARD By Square Cash

Free Checking Accounts No Monthly Fees, Free ATMs

No Debit Card Transactions Fees Till Rs. 2000 Why It Was

Chime Banking Visa debit card, Banking app, Banking

How To Choose The Best Prepaid Debit Card in 2020 Saving

Referral Varo Money realbanking Bank account, High

Post a Comment for "Fee Free Atm For Cash App"